tap into home equity without losing your low-interest-rate loan

As your home grows in value and you pay your monthly payments, the equity in your home grows. Homeowners may want to use that equity – for repairs & renovations, life events, or to create a prudent cash reserve for the future – but don’t want to lose their original loan’s lower interest rate. A 2nd Lien Loan is a great solution, a simple way to get cash out of your home in a high-rate market.

Ark’s 2nd Lien works for primary homes, second homes, and investment properties, for loans up to $500k. It’s even available for multi-family homes up to four units.

What would my monthly payments be?

Monthly payments are dependent on your purchase price, down payment, homeowners insurance, and taxes. If you would like a general ballpark, you can use the

Note: your loan-to-value ratio must be less than 80:20 to be eligible for a 2nd Lien.

2nd Lien Interest Rates

Rates for a 2nd Lien Loan are slightly higher than the rates for a primary mortgage. This is because it is riskier for a lender to offer you a second loan than a primary. Mortgage rates always change, and are dependent on multiple factors, and lenders offer you a rate based on both your financial health and the current market.

While the rates for a 2nd Lien Loan may be higher than other mortgage types, it still could be a great move. For example, if you plan on using that 2nd Lien to pay off credit card debt, you can significantly reduce the interest rate you are currently paying on your credit card balances (upwards of 22% in 2023). This can lead to substantial savings in the long run.

FAQs

Is it hard to get a 2nd Lien loan?

No, in fact it is often easier, although you need to have enough equity in the home to apply.

Will it affect my current interest rate?

Nope. That’s the beauty of it. If you have a low interest rate on your current mortgage, you keep it for its full term, or until you sell or refinance the home.

Can I even refi investment properties?

Yes you can, and a lot of our investors do. It’s a great way to get cash to build your empire!

Ready to figure out your options?

Ark Advisors are here to help.

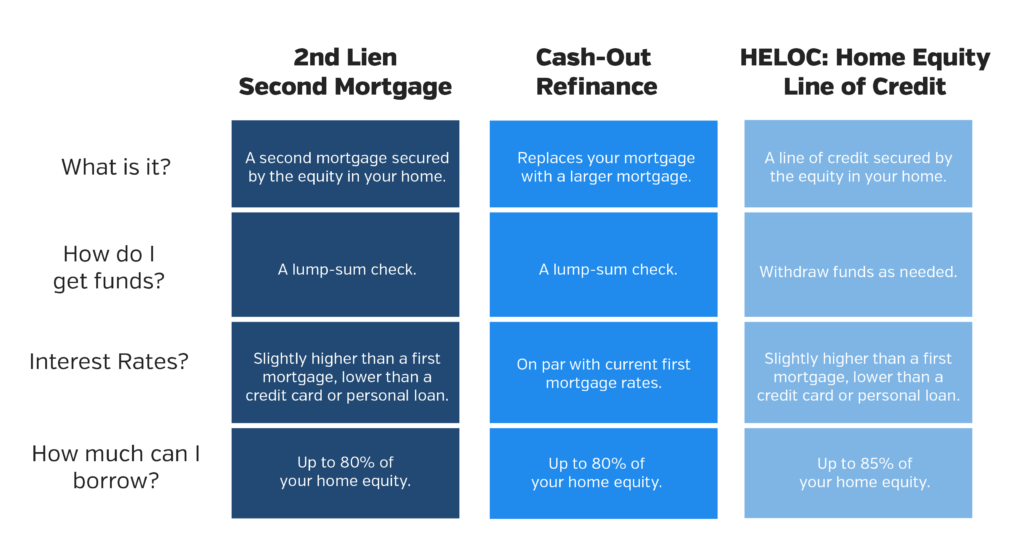

Comparing Loan Options

There are many ways to tap into your home equity, with pros and cons to each option. Every household’s financial situation is unique, so different loan types will work better for different families. Be aware that like all home mortgage loans, 2nd Lien Loans are tax deductible, whereas HELOCs are not. Here is a chart that may help you understand other differences:

Mortgage Calculator

If you want to figure out what your monthly payment for a 2nd Lien Loan may look like, use our mortgage calculator below. If you make the purchase price the equity you plan to take out, you can get a ballpark of what a monthly payment may look like.